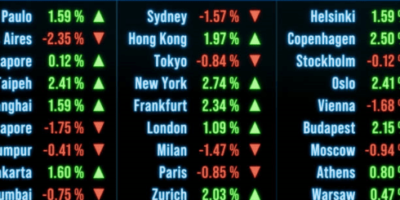

The fintech revolution has reshaped the financial landscape, offering new opportunities for investors. Among the myriad of investment options, fintech stocks have emerged as a focal point. As investors look to diversify their portfolios, understanding the dynamics of financial technology companies becomes crucial. One aspect to consider is the RVNL share price, which often reflects broader market trends and investor sentiment in the fintech sector.

Investing in fintech stocks can be a lucrative endeavor. Companies in this sector leverage technology to provide financial services more efficiently than traditional banks. This includes everything from mobile payments and digital wallets to blockchain and robo-advisors. The RVNL share price can serve as a barometer for the performance of fintech stocks, given its alignment with technological advancements and market acceptance.

One of the key drivers behind the surge in fintech stocks is the growing adoption of digital banking. Consumers are increasingly favoring digital platforms for their banking needs, prompting traditional banks to innovate or partner with fintech firms. Observing the RVNL share price can provide insights into how these innovations are received by the market, helping investors make informed decisions.

Moreover, the regulatory environment is gradually becoming more favorable towards fintech companies. Governments and financial regulators are recognizing the benefits of fintech innovations, leading to policies that support growth and integration into the mainstream financial system. The RVNL share price often reacts to these regulatory changes, making it a useful indicator for investors tracking the sector’s regulatory landscape.

Another important factor is the influx of venture capital into fintech startups. Investors are pouring billions into fintech firms, driving rapid growth and innovation. This influx of capital not only boosts the companies directly but also positively influences the RVNL share price, reflecting investor confidence and market potential. Keeping an eye on such trends can help investors spot potential winners and stocks in the fintech space.

The competitive landscape in the fintech sector is also evolving. Established tech giants are entering the financial services arena, bringing with them substantial resources and customer bases around the stocks. This increased competition can drive further innovation and growth within the sector. As these dynamics play out, the RVNL share price can offer clues about market sentiment towards these new entrants and their impact on existing players.

Global economic conditions also play a significant role in the performance of fintech stocks. In times of economic uncertainty, fintech companies can offer solutions that are more efficient and cost-effective compared to traditional financial services. Tracking the RVNL share price during such periods can provide insights into how these companies are positioned to weather economic downturns and capitalize on recovery phases.

Lastly, consumer behaviour and preferences are pivotal in driving the success of fintech companies. The shift towards online and mobile financial services is a trend that shows no signs of slowing down. As fintech companies continue to innovate and cater to these changing preferences, the RVNL share price often mirrors the market’s response to these innovations, helping investors gauge future potential.

Thus, the fintech revolution presents a wealth of opportunities for savvy investors. By closely monitoring indicators like the RVNL share price, investors can gain valuable insights into the performance and potential of fintech stocks. As the sector continues to evolve, staying informed about market trends, regulatory changes, and consumer behaviors will be key to making successful investment decisions in financial technology.

Leave a Reply

You must be logged in to post a comment.